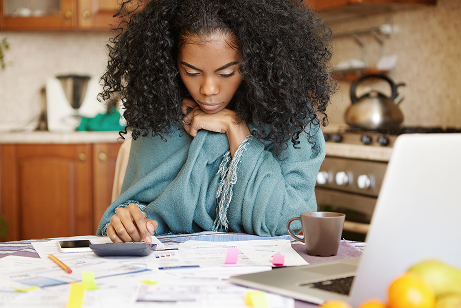

We’re here to help

It can be very stressful if your mortgage becomes difficult to afford. The sooner you contact us to talk through your circumstances, the more likely we’ll be able to help you find a manageable solution and avoid more serious debt problems.

How can we help?

Get in contact and we can discuss your individual circumstances. You can have someone talk on your behalf by filling out a third party authority form.

Help at every step

The mortgage charter

To combat the high mortgage rates, the government announced the creation of their “mortgage charter”, which was designed to support homeowners experiencing financial difficulty.

We have implemented the key support measures set out by the mortgage charter in addition to our own short- and long-term solutions for customers struggling to afford their mortgage. You’ll find more information about these supports below.

Organisations that can help

Free, confidential and independent advice on how to deal with debt problems. Includes web chat and email help.

Offers free, confidential and impartial advice, including via webchat, on legal, money and other problems.

Christian-based debt service and money management courses aimed at helping people out of debt and poverty.

Provide independent advice and financial support if you’re struggling with your energy bills, no matter who your provider is.

Enables anyone at risk of losing their home to get free legal advice and representation in court, regardless of their financial circumstances.

Act on behalf of a loved one

If you’d like us to speak to someone else regarding your situation, please fill out a third party authority form and send it to [email protected].

Your authorised third party can be a relative, a friend, carer or an appointed professional such as a solicitor or debt adviser.